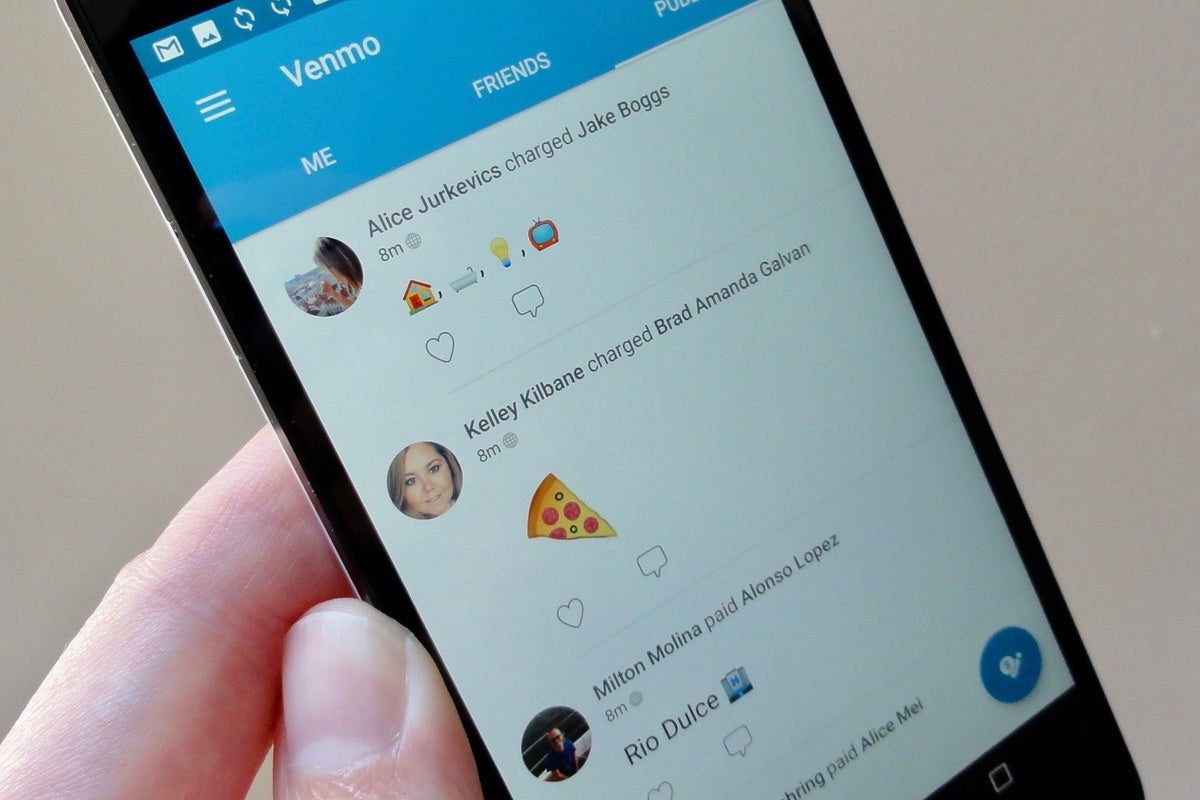

Convenience: Venmo is easy to use and has a user-friendly interface, making it a popular choice for P2P transactions.Social features: Venmo has a social aspect, allowing users to add comments and emojis to transactions and see their friends’ payment activity.

Paypal vs venmo security free#

Free transactions: Venmo does not charge fees for sending or receiving money from friends and family.Venmo can be linked to a bank account, debit card, or credit card, and users can make payments to individuals or businesses. It allows users to send and receive money from friends and family members quickly and easily, making it a popular choice for splitting bills, paying rent, and other P2P transactions. Venmo was founded in 2009 and is a popular digital payment app in the United States. In the next section, we will take a look at Venmo and see how it compares to PayPal. However, its fees and transfer limits may not make it the best choice for everyone. Overall, PayPal is a reliable and trusted payment platform with a wide user base and acceptance. Sending money internationally: varies by country, but can be up to 7.4% of the transaction amount.Currency conversion: 3.5% above the wholesale exchange rate.Receiving payments: 2.9% + $0.30 per transaction (varies by country).PayPal charges fees for certain transactions, including: While the company has taken steps to improve security, some users may still be concerned about the safety of their money and personal information. Security concerns: Like any online payment platform, PayPal has had security issues in the past.This can be a problem for users who need to transfer large amounts of money. Transfer limits: PayPal has limits on how much money can be transferred per transaction, per day, and per week.These fees can add up and make PayPal more expensive than other payment apps. Fees: PayPal charges fees for some transactions, including currency conversion fees and fees for receiving payments.Buyer protection: PayPal offers buyer protection for eligible purchases, which can give users peace of mind when shopping online.International transfers: PayPal allows for international money transfers in over 100 currencies, which is convenient for users who need to make payments to people in other countries.Wide acceptance: PayPal is accepted by millions of merchants and online retailers, making it easy to use for online shopping.

So whether you’re a business owner looking to process payments, someone who regularly sends money to friends and family, or just someone looking for a convenient way to pay for goods and services online, this article will help you make an informed decision about which app to use.

Finally, we will provide tips for choosing the right app for your needs and offer a conclusion that summarizes our findings. We will then compare the features of each app side-by-side and evaluate their user interface and experience. We will begin by giving a brief overview of each app, discussing their pros and cons, and explaining how their fees work. In this article, we will compare PayPal and Venmo to help you decide which one is the right fit for your personal finance needs. While they may seem similar at first glance, there are some key differences between the two that make them suited for different types of transactions. Two of the most popular payment apps out there are PayPal and Venmo. As we move further into the digital age, we are seeing more and more people rely on digital payment apps for their personal finance transactions.

0 kommentar(er)

0 kommentar(er)